Committee Chair: Sean MacDonald

Contact: ttocs@saanichteachers.com

Committee Members: Rebecca Bisset, Matt Coulson

The STA acknowledges that being a TTOC and new to position teacher requires a special level of skills and responsibility, which comes with its own unique needs. To address these needs, the STA TTOC Committee serves to support TTOCs and new teachers in navigating complex issues and finding success in their roles.

Please contact your TTOC rep or local president if you have any questions.

Relevant Information

TTOC Professional Development Policy

School District #63 supports the professional development for TTOCs as per our Collective Agreement. The board provides $7500.00 per year to be used for professional development workshops and resources for TTOC’s. The Joint Professional Development Committee oversees, administers and reviews the use of funds.

Details of accessing personal professional development money is as follows:

- Amount not to exceed $500.00 in one school year. TTOCs who are attending conferences located North of Nanaimo OR on the mainland can apply for an additional $100.

- 8 call-outs are needed in the current school year prior to applying. (Not 8 full days, just 8 separate ESS call outs)

- Original receipts to be provided with TTOC Pro-D & Travel Expense Claim form (see PD link on STA website)

- All Pro-D claims should be submitted prior to June 15th of that school year to the STA office, Attn: Pro-D Chairperson. Members who miss the deadline may apply for special consideration to the Joint Professional Development Committee who will review the circumstances surrounding the late application. This process will occur in September of the following school year and will also be dependent on the amount of money left in the TTOC Pro-D account.

- TTOCs will be eligible to apply for a day of pay to attend the February Tapestry Conference. Details of this program can be found on Page 15 of the Professional Development Handbook.

- TTOC’s who also hold a temporary contract may access the TTOC Pro-D account OR their school account but not both.

- TTOC’s who wish to appeal a decision can do so in writing. Correspondence should be sent to the STA office, ATTN: Pro-D Chairperson.

- TTOCs are also invited to join the STA Mentorship Program. All rules governing participation are set by the mentorship committee.

Once the fund is depleted, the Joint Professional Development Committee will revise the policy on the use of these funds.

Uses of TTOC Pro-D Funds

Money from the TTOC Pro-D Fund may be used for:

- professional conference registration and related expenses

- professional workshops in and out of the district

- school visits

- academic non-credit courses that cannot be claimed for income tax purposes

- professional association membership dues

- expenses and honoraria for presenters

- individual research expenses excluding personal payment

- professional journals

- staff retreats/staff development activities

- release time for staff-initiated meetings and work sessions

NOTE: Professional Development funds may not be used to purchase equipment of any kind.

Still not sure what qualifies as Professional Development? Check out Guidelines for Uses of Pro-D Funds – click HERE

TTOC Sick Leave Information

Those employees who don’t already earn and accrue five (5) days of annual paid sick leave will now have that time available to them if/as needed based on the following parameters:

You have been employed for a minimum of ninety (90) consecutive days

You have worked at least one (1) day in the preceding thirty (30) days

The sick day falls on a day in which you have been called and are scheduled to work

Sick leave is only triggered when a shift has been scheduled and accepted. The district is unable to simply have staff ‘claim a sick day’ when there is no scheduled day to revert to sick leave. This is intended to cover days that would have otherwise been worked as they are already in the schedule.

The district is asking those who have scheduled work and are unable to attend due to illness to email hr_teaching@saanichschools.ca with the following information PRIOR TO the cancellation of your scheduled shift:

- Date

- Location scheduled to work

- The teacher you are covering for

- Start and end time

- ADS Confirmation Number (if booked through ADS system)

Once the email has been sent to hr_teaching@saanichschools.ca you can remove yourself promptly from the scheduled shift so that it can be called out once again.

If you have immediate questions you are welcome to send them to hr_teaching@saanichschools.ca.

TTOC Events

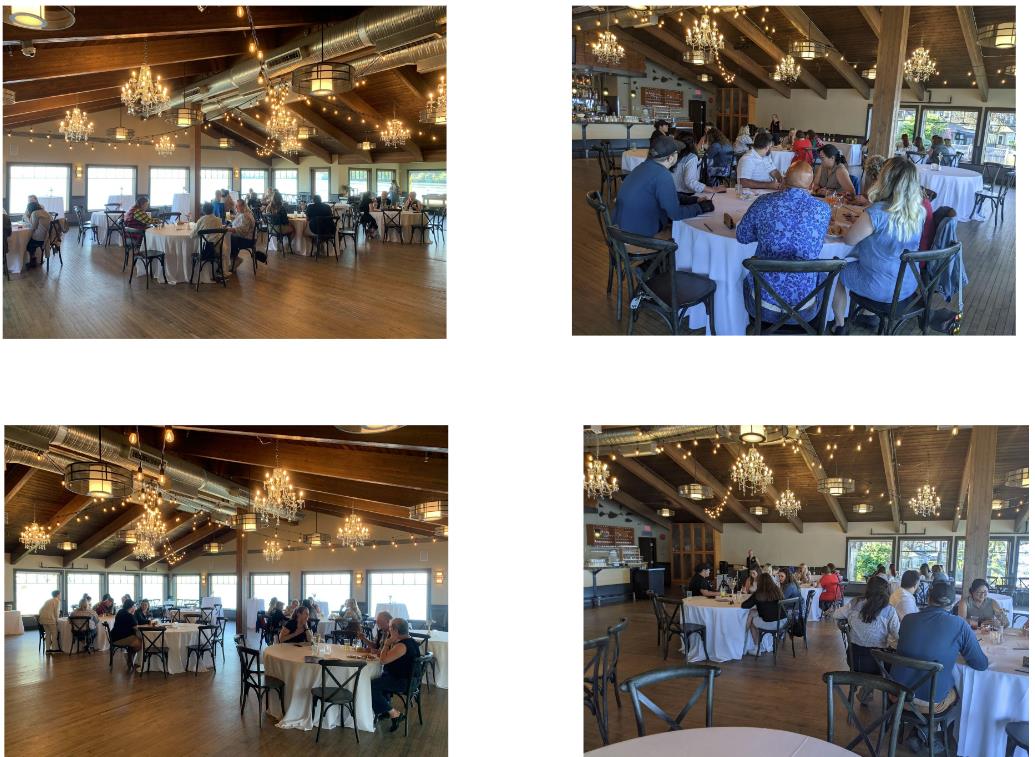

TTOC and New Teacher Appreciation Dinner & Trivia Night

Thank you to all who attended our TTOC and New Teacher Appreciation Dinner & Trivia Night at the beautiful Beach House restaurant. Attendees enjoyed dinner, drinks, trivia and draw prizes from local businesses. This evening was a celebration of new teachers and TTOCs. They play a vital role in supporting our staff and students. We greatly appreciate their hard work and dedication.